In the dynamic world of personal finance and real estate, understanding how to optimize your largest asset—your home—is paramount. For many homeowners, refinancing a mortgage presents a powerful opportunity to adjust financial terms, reduce costs, or unlock home equity. However, a common question often arises: how soon can I refinance my house after purchasing it or after a previous refinance? At Daily98news, we recognize the importance of precise, data-backed guidance in making such significant financial decisions. This article will delve into the intricacies of mortgage refinancing, exploring the crucial “seasoning periods” and other vital eligibility criteria that determine when this strategic move becomes a viable option for you.

Understanding Mortgage Refinancing: A Strategic Financial Tool

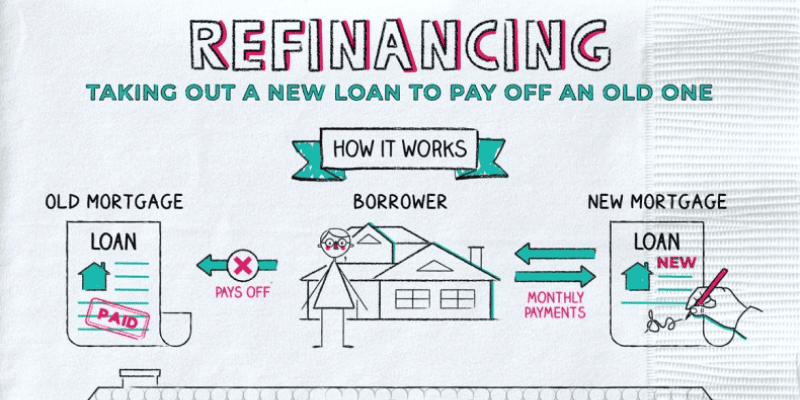

Mortgage refinancing involves replacing your existing home loan with a new one, often with different terms and conditions. It is not merely a change of paperwork but a complete overhaul of your mortgage agreement. Homeowners typically consider refinancing for a variety of strategic financial reasons. The most common objective is to secure a lower interest rate, which can significantly reduce monthly payments and the total interest paid over the life of the loan. Another popular goal is to shorten the loan term, allowing you to pay off your mortgage faster and build equity more quickly, albeit often with higher monthly payments.

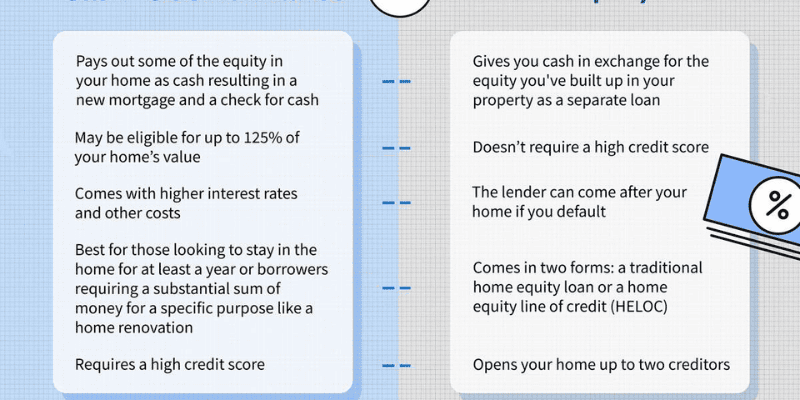

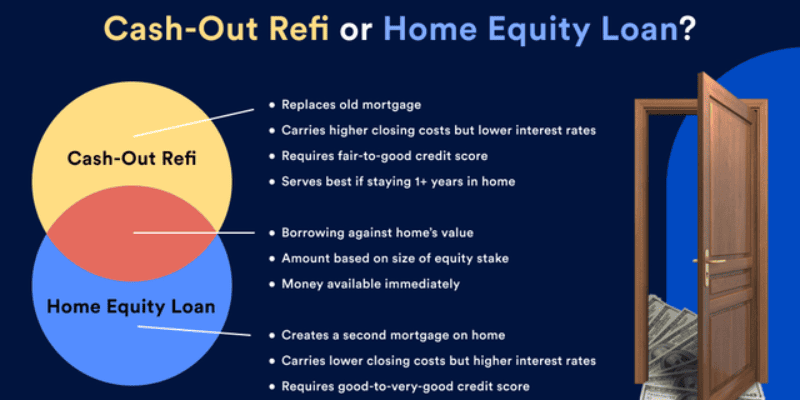

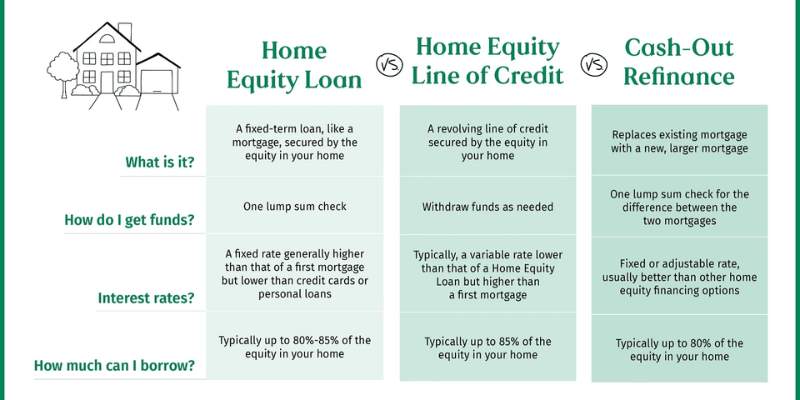

Beyond adjusting rates and terms, refinancing can also be a valuable tool for accessing your home’s equity through a “cash-out refinance.” This option allows you to borrow a larger sum than your outstanding mortgage balance and receive the difference in cash, which can then be used for significant expenses like home improvements, debt consolidation, or education. Given these substantial benefits, understanding the eligibility landscape, particularly the timing, is critical for any homeowner looking to leverage their mortgage strategically.

How Soon Can You Refinance Your House? Demystifying Seasoning Periods

The most direct answer to how soon can I refinance my house is that it largely depends on the type of loan you have and the specific refinancing program you are pursuing. Lenders and loan programs often impose “seasoning requirements,” which are minimum waiting periods after your original loan closing or a previous refinance before you become eligible for a new mortgage. These periods are designed to ensure stable ownership and a track record of responsible payment behavior.

It is essential to differentiate between a rate-and-term refinance and a cash-out refinance (borrowing against your home’s equity). Cash-out refinances generally have stricter seasoning requirements due to the increased risk for lenders.

Conventional Loans

For conventional loans, which are not government-insured, the seasoning requirements can vary. For a rate-and-term refinance, you may be able to refinance almost immediately after your previous closing, often as soon as 30 days. Some lenders, however, may impose their own six-month waiting period, especially if you intend to refinance with the same lender.

Cash-out refinances for conventional loans typically require a longer waiting period. Most lenders mandate a six-month waiting period after your original mortgage closing before you can qualify for a conventional cash-out refinance. It’s important to note that recent changes from Fannie Mae and Freddie Mac may require a full year of seasoning for cash-out refinances to use the current appraised value of the property. This is to ensure borrowers have made consistent payments and built sufficient equity.

FHA Loans

FHA (Federal Housing Administration) loans, known for their more flexible credit and down payment requirements, also have specific seasoning rules. For an FHA Streamline Refinance, which allows homeowners to refinance an existing FHA loan with minimal documentation, you typically need to wait at least 210 days from your original loan’s first payment due date and have made at least six on-time monthly payments.

For a standard FHA rate-and-term refinance, a six-month wait and a solid payment history are generally required. If you are considering an FHA cash-out refinance, the waiting period is typically longer, requiring at least 12 months of homeownership and a record of on-time payments for the past year. The property must also have been occupied as your primary residence.

VA Loans

VA loans, insured by the U.S. Department of Veterans Affairs for eligible service members and veterans, also have specific seasoning requirements. For an Interest Rate Reduction Refinance Loan (IRRRL), often called a VA Streamline Refinance, you must typically wait until the later of (1) 210 days from the first payment due date of the original loan or (2) the date you have made six consecutive monthly payments on the loan being refinanced.

For a VA cash-out refinance, while there isn’t always a specific waiting period mandated by the VA, most lenders prefer to see at least 6-12 months of payments on your current loan. Some lenders may even have their own waiting periods, often around 12 months, to ensure sufficient equity and payment reliability.

USDA Loans

USDA loans, designed for rural homeowners, generally have a seasoning requirement of 12 months of on-time payments before you can refinance. Both streamlined-assist and non-streamlined USDA refinances typically require a 12-month waiting period.

Understanding these distinct timelines for each loan type is crucial when asking how soon can I refinance my house. It’s always advisable to consult with a qualified mortgage professional to assess your specific situation and determine the most opportune moment.

Key Eligibility Requirements Beyond Time

While “seasoning” is a critical factor in determining how soon can I refinance my house, it’s far.

Credit Score and Payment History

Your credit score is a primary indicator of your financial responsibility and directly influences the interest rate you’ll be offered. For conventional loans, most lenders require a minimum credit score of 620, though a score of 740 or higher can secure the most favorable rates. FHA and VA loans often allow for lower minimum credit scores, sometimes as low as 580. Regardless of the loan type, a strong payment history on your current mortgage—typically no late payments in the past 6 to 12 months—is essential. This is particularly important for cash-out refinances, where a credit score of at least 640-680 may be required.

Home Equity and Loan-to-Value (LTV) Ratio

Home equity, which is the portion of your home you own outright, plays a significant role in refinancing eligibility. Most lenders prefer you to have at least 20% equity in your home, meaning your Loan-to-Value (LTV) ratio should be 80% or lower. A higher equity position can lead to more attractive interest rates and terms. For cash-out refinances, lenders often have stricter LTV limits, typically allowing you to borrow up to 80% of your home’s value while retaining at least 20% equity. Some VA cash-out refinances may even allow up to 100% LTV, though this can vary by lender. If your equity is lower than 20%, you might be required to pay private mortgage insurance (PMI) on a conventional loan, increasing your monthly expenses.

Debt-to-Income (DTI) Ratio and Income Stability

Lenders also examine your Debt-to-Income (DTI) ratio, which compares your total monthly debt payments (including the proposed new mortgage payment) to your gross monthly income. A lower DTI ratio indicates a greater ability to manage your debts. Conventional loan programs typically prefer a DTI ratio below 50%, with many lenders preferring it to be 36% or less. While some programs may allow higher ratios, a DTI of 43% or less is generally considered ideal for securing favorable terms. Lenders will also require proof of reliable and stable income, often asking for two years of employment history, pay stubs, W-2 forms, and tax returns to ensure you can comfortably afford the new mortgage payments.

The Refinancing Process: A Step-by-Step Guide

Once you’ve determined how soon you can refinance your house and you meet the other eligibility criteria, navigating the actual refinancing process requires a clear understanding of each stage. While similar to obtaining your initial mortgage, there are specific nuances to refinancing.

Step 1: Assess Your Financial Goals and Market Conditions

Before even applying, critically evaluate your reasons for refinancing. Are you aiming for a lower interest rate, a shorter loan term, or cash out? Monitor current interest rates and economic indicators like the Consumer Price Index (CPI) and Federal Reserve interest rate announcements. Refinancing makes the most sense when market rates are significantly lower than your current rate, ideally by at least 0.5% to 1.0%, to ensure the benefits outweigh the costs.

Step 2: Shop Around for Lenders and Get Pre-Qualified

Don’t settle for your current lender without comparison. Different lenders offer varying rates, fees, and programs. Obtain quotes, lenders will typically pre-qualify you, providing an estimate of what you might be approved for based on a preliminary review of your financial information. This involves a “soft inquiry” on your credit, which doesn’t impact your score.

Step 3: Complete the Loan Application

Once you select a lender, you’ll complete a full application, which requires detailed financial documentation. This includes proof of income (pay stubs, W-2s, tax returns), bank statements, investment account statements, and information about your current mortgage. This step involves a “hard inquiry” on your credit report, which may temporarily ding your credit score.

Step 4: Home Appraisal and Underwriting

The lender will order a home appraisal to determine your property’s current market value. This is crucial for calculating your home equity and LTV ratio. Concurrently, the loan undergoes underwriting, where the lender thoroughly reviews all your submitted documents, credit history, and the appraisal to assess the risk and confirm your eligibility for the new loan. Certain streamline refinance programs, like FHA Streamline or VA IRRRL, may not always require a full appraisal if specific criteria are met.

Step 5: Closing the Loan

If approved, you’ll receive a Closing Disclosure detailing all the final terms, costs, and fees associated with your new mortgage. Carefully review this document. At closing, you’ll sign numerous legal documents, officially replacing your old mortgage with the new one. Refinancing incurs closing costs, just like your initial home purchase, typically ranging from 2% to 6% of the new loan amount.

Costs and Considerations of Refinancing

While the prospect of lower interest rates or accessible equity is appealing, refinancing is not without its costs. A comprehensive understanding of these expenses is vital to determine if a refinance will truly provide a net financial benefit.

Understanding Closing Costs

Refinancing, much like purchasing a home, involves various closing costs. These are fees paid to lenders and third parties to process and finalize your new loan. Expect these costs to typically range from 2% to 6% of your new loan principal, though they can vary based on your lender, credit score, and location.

Common refinancing costs include:

- Loan Origination Fees: Charged by the lender for processing the loan, often 0.5% to 1% of the loan amount.

- Appraisal Fees: To determine the current market value of your home, typically ranging from $600 to $2,000.

- Title Services and Title Insurance: A new lender’s title insurance policy is usually required every time you refinance to protect the lender in case of future title disputes.

- Credit Report Fees: For pulling your credit history.

- Government Recording Costs: Fees paid to local government for recording the new mortgage.

- Attorney Fees: If required in your state for closing.

- Underwriting Fees: For the lender’s risk assessment.

“No-Cost” Refinances

You might encounter offers for a “no-cost refinance.” It’s crucial to understand that there’s no truly “free” loan. Lenders typically roll these closing costs into a slightly higher interest rate or add them to the loan principal. While this avoids upfront out-of-pocket expenses, it means you’ll pay more in interest over the life of the loan. Carefully evaluate if the higher interest rate negates the savings you seek.

The Break-Even Point

To accurately assess the financial benefit of refinancing, calculate your break-even point. This is the amount of time it will take for your monthly savings, if refinancing costs you $3,000 but saves you $100, your break-even point is 30 months (2.5 years). If you plan to sell your home or refinance again before reaching this break-even point, the refinance may not be financially advantageous. Investment legends like Warren Buffett often emphasize long-term value, and this principle applies strongly to real estate decisions; ensuring you stay in the home long enough to realize savings is key.

When Is Refinancing the Right Move?

Deciding when to refinance goes beyond merely understanding how soon can I refinance my house; it requires a blend of market analysis, personal financial assessment, and clear goal setting. As a financial analyst, I stress that timing and strategic alignment are crucial for maximizing the benefits and minimizing the risks.

Favorable Market Conditions

A primary trigger for refinancing is a significant drop in prevailing interest rates since you secured your original mortgage. Even a 0.5% to 1.0% reduction can translate into substantial savings over a 15-year or 30-year term. Keeping a close eye on macroeconomic indicators such as the Federal Reserve’s interest rate policy and inflation reports (CPI) can provide clues about the direction of mortgage rates. When rates are trending downward, it presents an opportune window. However, it’s also important to acknowledge that rates can be volatile; as Ray Dalio might advise, understanding the “economic machine” and its cycles is paramount.

Personal Financial Goals

Your personal circumstances and financial goals should heavily influence your refinancing decision. Consider the following scenarios:

- Lowering Monthly Payments: If current rates are lower, refinancing to a new loan with a reduced interest rate can free up cash flow in your monthly budget, which can be redirected towards savings, investments, or other financial priorities.

- Shortening the Loan Term: For those with stable or increasing income, refinancing from a 30-year to a 15-year mortgage can save tens of thousands in interest over the life of the loan and accelerate equity accumulation. Be prepared for potentially higher monthly payments.

- Switching Loan Types: Moving from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage can provide payment stability and protection against rising interest rates. Conversely, if you plan to sell soon, an ARM might offer lower initial rates.

- Accessing Home Equity: If you need a lump sum for significant investments like home renovations that add value, debt consolidation at a lower interest rate, or funding education, a cash-out refinance can be a strategic option. However, remember that you are borrowing against your home, increasing your debt.

Potential Pitfalls and Risks

Despite the benefits, refinancing carries risks. Extending your loan term, even with a lower rate, can lead to paying more interest over the long run if you’ve already paid down a significant portion of your original loan. The closing costs, as discussed, can also be substantial and take years to recoup. Refinancing also involves a hard credit inquiry, which can temporarily lower your credit score. It’s crucial to perform a thorough cost-benefit analysis and ensure the move aligns with your long-term financial plan. As BlackRock’s investment philosophy often emphasizes, meticulous risk management is critical in all financial endeavors.

Conclusion

Understanding how soon can I refinance my house is a critical first step in a strategic financial decision that can significantly impact your wealth., and debt-to-income requirements, each detail plays a vital role. Daily98news encourages all homeowners to approach refinancing with discipline, data-backed analysis, and a clear vision of their financial goals. By carefully weighing the costs against the potential benefits, and seeking expert advice, you can make an informed choice that optimizes your home equity and contributes to your journey toward financial freedom. Remember, thoughtful planning and a disciplined approach are the cornerstones of successful long-term investing.