In today’s fast-paced world, securing adequate financial protection for your family and assets is paramount. Among the essential safeguards, car insurance stands out as a legal requirement and a critical component of responsible financial planning. For residents of Connecticut, navigating the complexities of auto insurance can often feel overwhelming, especially when the goal is to find the cheapest car insurance in CT without compromising on crucial coverage. In this article, Daily98news will accompany you on a journey to demystify the process, providing expert insights and practical strategies to help you make an informed decision, ensuring you get the best value for your hard-earned money while maintaining robust protection on the road.

Understanding car insurance in connecticut

Car insurance in Connecticut is not just a good idea; it’s a legal obligation designed to protect all drivers on the road. Understanding the fundamental requirements and the various factors that influence your premiums is the first step toward finding coverage that meets both your needs and your budget. Connecticut’s Department of Insurance outlines specific minimum liability requirements, ensuring that all licensed drivers carry a baseline level of protection. Beyond these legal mandates, a myriad of elements come into play when insurance companies calculate your individual rates, ranging. Grasping these core principles will empower you to make more strategic choices when seeking the cheapest car insurance in CT.

Minimum coverage requirements in ct

Connecticut law mandates that all registered vehicles carry certain minimum liability insurance coverages to operate legally. These requirements are put in place to ensure that in the event of an accident where you are at fault, there is financial protection for the injured parties and their property. Specifically, drivers must carry bodily injury liability coverage, which pays for injuries sustained by others, and property damage liability coverage, which covers damage to other people’s property. Additionally, uninsured/underinsured motorist coverage is a crucial component, protecting you and your passengers if you are involved in an accident with a driver who has no insurance or insufficient coverage. Meeting these minimums is non-negotiable, but savvy consumers often consider higher limits for greater personal protection.

Factors influencing premiums in ct

Numerous factors contribute to how car insurance premiums are calculated in Connecticut, making each policyholder’s rate unique. Your driving record, for instance, is a primary determinant; a history of accidents or traffic violations will almost certainly lead to higher costs, reflecting a greater perceived risk to the insurer. The type of vehicle you drive also plays a significant role, with newer, more expensive cars, or those with high theft rates, typically costing more to insure. Furthermore, your age, gender, credit history, and even where you reside within Connecticut can impact your rates, as urban areas with higher traffic density or theft rates may see increased premiums. Understanding these variables allows you to anticipate potential costs and identify areas where you might be able to reduce your expenses.

Strategies to find the cheapest car insurance in ct

Finding the cheapest car insurance in CT requires a proactive and informed approach. It’s not simply about picking the first quote you receive; rather, it involves strategic comparisons, leveraging available discounts, and customizing your coverage to strike the perfect balance between protection and affordability. Many drivers overlook the significant savings potential that lies in a thorough evaluation of their options and a clear understanding of how different policy choices impact their overall premium. By employing a few key strategies, you can significantly reduce your annual insurance costs without feeling exposed to unnecessary risks on the road.

Comparing quotes effectively

The most effective way to find competitive car insurance rates is to obtain quotes, apples-to-apples comparison. Utilizing online comparison tools can streamline this process, providing a snapshot of the market quickly and efficiently, highlighting where the best value for money might be found.

Bundling policies and discounts

Insurance companies often reward customers who purchase multiple policies, if you already have a homeowner’s, renter’s, or life insurance policy with a particular company, inquiring about adding your car insurance could result in a significant discount. Beyond bundling, a wide array of other discounts are typically available. These might include good driver discounts for those with clean records, good student discounts for young drivers maintaining high grades, multi-car discounts if you insure more than one vehicle, and even discounts for certain professions or affiliations. Always ask your agent about every potential discount you might qualify for, as these can collectively make a big difference in reducing your costs.

Adjusting deductibles and coverage levels

Your deductible is the amount you agree to pay out-of-pocket before your insurance coverage kicks in after a claim. Generally, choosing a higher deductible will lower your monthly or annual premium, as you are taking on more of the initial financial risk yourself. While this can be a smart strategy for reducing the cost of the cheapest car insurance in CT, it’s crucial to ensure you have sufficient savings to cover that higher deductible if an unexpected incident occurs. Similarly, reviewing your coverage levels is important. While meeting minimum liability requirements is essential, consider whether you need comprehensive and collision coverage for older vehicles whose market value may not justify the added premium cost. Balancing these elements effectively can lead to significant savings.

The role of your driving record and vehicle type

Your personal driving history and the characteristics of your vehicle are among the most significant determinants of your car insurance premiums in Connecticut. Insurers rely heavily on these factors to assess the level of risk you present, directly influencing the cost of your policy. A consistent record of safe driving habits not only contributes to road safety but also serves as a strong indicator of your reliability as a policyholder, often translating into more favorable rates. Conversely, a history marked by accidents or traffic violations signals a higher risk, which insurers typically offset with increased premiums. Understanding how these elements intersect is vital for anyone aiming to secure the most affordable coverage options.

Impact of clean driving history

Maintaining a clean driving record is arguably one of the most powerful tools at your disposal for securing affordable car insurance rates. Insurance companies heavily weigh your driving history, as it provides a clear picture of your past behavior behind the wheel. Drivers who have gone several years without accidents, traffic citations, or other violations are often eligible for significant “good driver” or “safe driver” discounts. These discounts can substantially lower your premiums, making a noticeable difference in the overall cost of your policy. Committing to responsible driving habits not only ensures your safety and the safety of others but also directly contributes to finding the cheapest car insurance in CT available to you.

Vehicle safety features and cost

The type of vehicle you drive profoundly impacts your insurance premiums. Modern cars equipped with advanced safety features, such as anti-lock brakes, airbags, anti-theft devices, and sophisticated driver-assistance systems (like lane departure warning or automatic emergency braking), are often less expensive to insure. These features reduce the likelihood of accidents and theft, thereby lowering the insurer’s potential payout for claims. Conversely, luxury vehicles, sports cars, or cars with a high incidence of theft or expensive repair parts can lead to higher premiums. Before purchasing a new car, it’s always wise to research its insurance costs, as this upfront knowledge can help you make a more informed decision and potentially save money in the long run.

Company reputation and financial strength

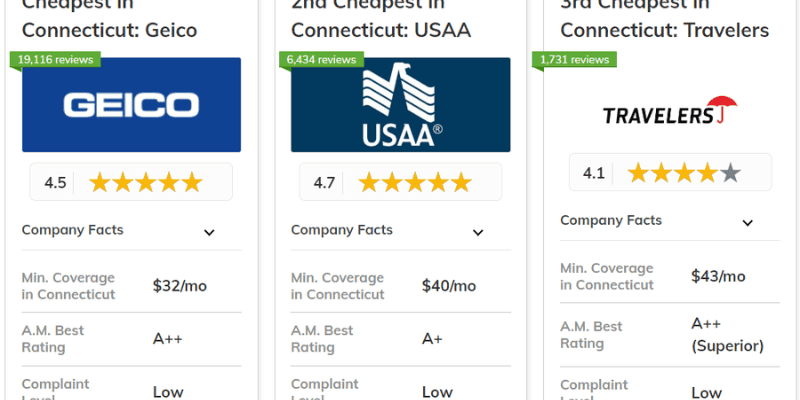

When evaluating car insurance options, particularly when searching for the cheapest car insurance in CT, it’s crucial to look beyond just the price tag. The financial strength and reputation of an insurance provider are paramount, as they directly impact the reliability of your coverage and the efficiency of the claims process when you need it most. A financially stable company is better equipped to pay out claims, even during widespread catastrophic events, ensuring you receive the support you’ve paid for without undue delay or difficulty. This aspect is especially important for policyholders who depend on their insurance for financial security following an accident.

Independent rating agencies specialize in assessing the financial health of insurance companies. While specific agency names cannot be mentioned, these organizations provide valuable insights into an insurer’s ability to meet its financial obligations. Looking for companies with strong ratings. A company’s reputation also extends to its customer service and claims handling. Reading customer reviews and professional assessments can provide a clear picture of how an insurer treats its policyholders,, even if it’s not the absolute cheapest, can prove to be the more cost-effective choice in the long run by avoiding potential frustrations and ensuring timely payouts.

Exploring less common discount opportunities

Beyond the standard discounts for bundling policies or maintaining a clean driving record, many insurance companies offer a variety of less commonly known opportunities for reducing your premiums. These often specific and unique discount programs can add up to significant savings, helping you secure the cheapest car insurance in CT that aligns with your specific lifestyle and driving habits. Proactively inquiring about these specialized options can uncover additional ways to lower your costs, proving that a little extra research can go a long way in optimizing your insurance expenses.

Telematics programs and usage-based insurance

Telematics programs, often referred to as usage-based insurance, represent a modern approach to premium calculation. These programs involve installing a small device in your car or using a smartphone app that monitors your driving habits, such as mileage, speed, braking patterns, and the time of day you drive. If you demonstrate safe driving behaviors, the insurer may reward you with lower premiums. This option is particularly beneficial for drivers who have excellent habits but might not otherwise qualify for significant discounts based on other factors. It offers a personalized pricing model, allowing careful drivers to directly influence their insurance costs based on their actual risk profile.

Professional affiliations and loyalty discounts

Many insurance providers partner with various organizations, employers, or alumni associations to offer exclusive discounts to their members. If you are a member of a professional organization, a union, an affinity group, or an alumnus of a specific university, it’s worth checking if your insurer has any special agreements that could translate into a discount. Additionally, some companies offer loyalty discounts to long-term policyholders, recognizing their continued business. While these discounts might not always be heavily advertised, a direct inquiry to your insurance agent or a thorough review of the insurer’s website can uncover these valuable savings opportunities.

What to review in your policy details

Obtaining the cheapest car insurance in CT involves more than just comparing premium prices; it also requires a meticulous review of the policy’s fine print. Understanding the specific terms, conditions, and operational mechanics of your insurance contract is crucial to ensuring that you are adequately protected and that there are no unexpected gaps in your coverage. Many policyholders mistakenly assume that all policies are essentially the same, leading to potential disappointments during the claims process. A thorough examination of your policy details can prevent future headaches and provide clarity on what you can expect.

Understanding exclusions and limitations

Every insurance policy contains specific exclusions and limitations that define what is and is not covered. Exclusions are events or circumstances for which the insurance company will not provide coverage, while limitations specify the maximum amount the insurer will pay for a covered event. For example, some policies might exclude damage caused by intentional acts, or they might limit coverage for custom modifications to your vehicle. It is vital to read these sections carefully to avoid any surprises if you need to file a claim. If you are unsure about any specific clause, it is always best to seek clarification from your insurance agent or a qualified insurance consultant to ensure a complete understanding of your policy’s boundaries.

The claims process explained

Knowing how to navigate the claims process is just as important as understanding your coverage. While you hope never to need it, being prepared for an accident or incident can significantly reduce stress and streamline the resolution. Typically, the claims process begins with reporting the incident to your insurer as soon as safely possible. You will then need to provide detailed information, potentially including photos, police reports, and contact information for other parties involved. The insurance company will assign an adjuster to investigate the claim, assess damages, and determine coverage. Understanding these steps and your responsibilities as a policyholder can help ensure a smooth and efficient experience, leading to a timely and fair resolution.

Final thoughts

Navigating the landscape of car insurance in Connecticut can seem daunting, but by adopting a strategic and informed approach, you can effectively secure the cheapest car insurance in CT without sacrificing essential protection. Daily98news encourages you to thoroughly research your options, compare quotes, you’ll not only save money but also gain the peace of mind that comes with knowing you and your family are well-protected on the road.