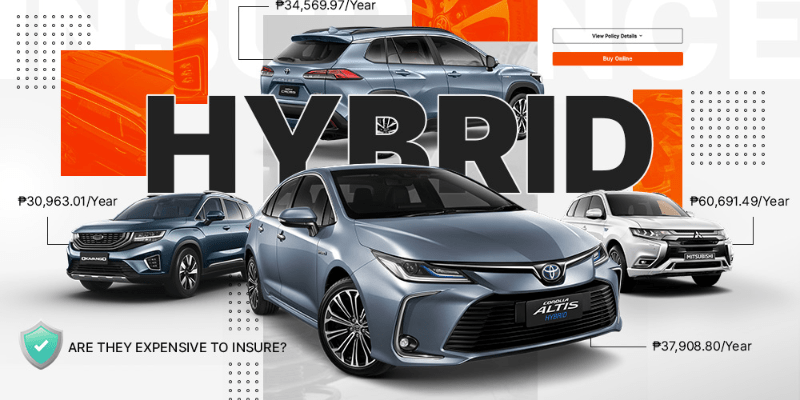

In today’s rapidly evolving automotive landscape, hybrid vehicles stand as a compelling bridge between traditional internal combustion engines (ICE) and full electric vehicles (EVs). They offer the promise of improved fuel efficiency and reduced emissions, making them an attractive option for environmentally conscious drivers and those seeking to mitigate rising fuel costs. However, a question frequently arises for prospective buyers: are hybrid cars more expensive to insure? In this article, Daily98news will accompany you to explore the intricate factors that influence hybrid car insurance premiums, delving into the technical and market dynamics that shape these costs. Our aim is to provide a comprehensive, data-driven analysis to help you make an informed decision when considering your next vehicle purchase.

The Technical Complexity Behind Hybrid Insurance Premiums

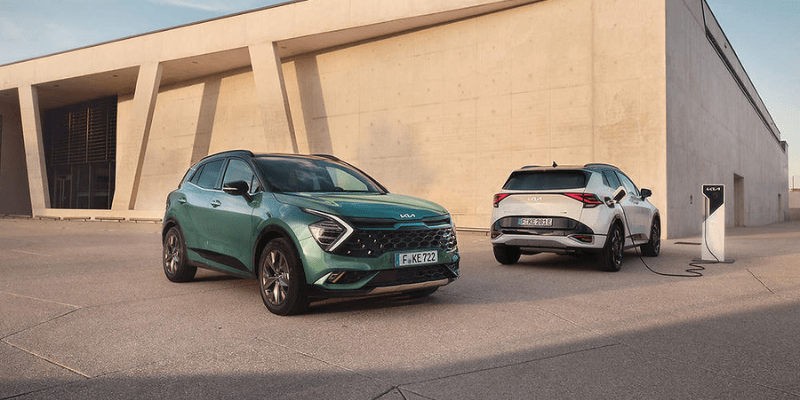

Hybrid vehicles, by their very nature, incorporate a sophisticated blend of gasoline engine components and electric powertrain elements. This dual-system design, while offering significant operational advantages, also introduces complexities that directly impact insurance costs. Understanding these technical nuances is crucial to comprehending why are hybrid cars more expensive to insure.

The integration of an internal combustion engine with an electric motor, a high-voltage battery pack, and a power control unit creates a more intricate system compared to a conventional gasoline-powered car. This complexity extends to every aspect of the vehicle,.

Higher Initial Vehicle Value and Parts Cost

A primary driver of higher insurance premiums for hybrid cars is their elevated purchase price compared to similarly sized or equipped gasoline-only counterparts. On average, hybrid cars can be 20% more expensive to buy than traditional gasoline vehicles. This higher initial cost directly translates into increased insurance liability. Should a hybrid vehicle be stolen or declared a total loss, the insurer faces a greater payout.

Furthermore, the specialized components unique to hybrid powertrains are often more expensive to replace than those found in conventional vehicles. For example, replacing a hybrid vehicle’s battery pack can range from $1,000 to $6,000, and sometimes even up to $20,000, a stark contrast to the $100-$200 cost for a standard ICE car battery. Beyond the battery, other specialized parts like electric motors, power electronics, and hybrid drivetrains contribute to higher material costs for repairs. This inherent value and the expense of specialized parts are fundamental reasons why are hybrid cars more expensive to insure.

Specialized Repair and Maintenance Requirements

The sophisticated technology within hybrid vehicles necessitates specialized knowledge and tools for diagnostics and repair. Repairing a hybrid car can be significantly more expensive than a standard gasoline car, partly because only specialized, highly skilled mechanics are qualified to work on these complex systems. These specialized labor costs, coupled with the higher price of replacement parts, drive up the average repair costs following an accident. This directly affects insurance premiums, as insurers factor in the potential cost of claims when calculating rates.

Even routine maintenance can have nuances. While some hybrid systems, like regenerative braking, can extend the life of brake pads significantly, other specialized procedures or diagnostic needs can arise. The overall complexity means that the repair industry must adapt, leading to higher labor rates for certified hybrid technicians.

Evaluating Risk: How Insurance Companies Assess Hybrid Vehicles

Insurance companies are in the business of assessing and mitigating risk. When determining premiums for any vehicle, they consider a multitude of factors, and hybrid cars are subject to a unique set of evaluations. While their environmental benefits are clear, the financial risks associated with their advanced technology and repair needs often push premiums higher. Understanding these risk assessments helps clarify why are hybrid cars more expensive to insure.

Beyond the direct costs of parts and labor, insurers also look at factors like theft rates, accident frequency, and the severity of damage. The dual powertrain of a hybrid can be seen as both an advantage and a disadvantage in this assessment, influencing various aspects of their risk profile.

Accident Statistics and Liability Concerns

While hybrid cars often come equipped with advanced safety features, their heavier build due to battery packs can be a “double-edged sword” in collisions. They can absorb more damage, potentially reducing bodily injury risk for their occupants, but simultaneously cause greater damage to other vehicles, leading to higher liability compensation claims. Some studies have indicated that hybrids might have a higher risk of accidents involving pedestrians or cyclists due to their quieter operation at low speeds.

Conversely, hybrids are generally considered safer to drive on average, with lower fatality rates in accidents. This contradiction in data highlights the complexity of risk assessment for these vehicles. Insurers continually analyze real-world accident data to fine-tune their premium calculations.

Advanced Driver-Assistance Systems and Their Dual Impact

Many hybrid vehicles are at the forefront of automotive technology, often incorporating advanced driver-assistance systems as standard or optional features. These systems, including adaptive cruise control, lane-keeping assistance, and automatic emergency braking, are designed to enhance safety and prevent accidents. The Insurance Institute for Highway Safety (IIHS) has shown that forward collision warning systems with automatic emergency braking can reduce front-to-rear crashes by up to 50%. This reduction in accident frequency and severity can lead to lower insurance claims and, consequently, potential discounts on premiums.

However, ADAS also presents a significant cost challenge for insurers. The sophisticated sensors, cameras, and radar systems integral to ADAS are expensive to replace and require precise calibration after even minor repairs. A simple bum. This interplay of reduced accident likelihood and increased repair expense is another layer in determining whether are hybrid cars more expensive to insure.

Comparative Analysis: Hybrid vs. Gasoline Car Insurance Costs

When directly comparing insurance costs, data generally indicates that hybrid vehicles tend to be slightly more expensive to insure than their gasoline-powered counterparts. Several sources suggest that hybrid car insurance can be anywhere from 5% to 11% higher on average. This differential is primarily attributed to the factors discussed: higher purchase price, more expensive specialized parts, and the need for expert repair services.

However, this comparison isn’t always straightforward and can vary significantly based on specific models, geographic location, and individual driver profiles. Some hybrid models may even have lower premiums than their gasoline equivalents due to excellent safety ratings or lower theft rates.

Key Factors Beyond Vehicle Type

While the vehicle itself plays a significant role, numerous personal factors also heavily influence insurance premiums for both hybrid and gasoline cars:

- Driver’s Age and Driving Record: Younger drivers or those with a history of accidents and traffic violations typically face higher rates. A clean driving record is consistently rewarded with lower premiums.

- Location: Urban areas with higher crime rates or traffic congestion often incur higher insurance costs.

- Coverage Levels and Deductibles: Opting for comprehensive coverage and lower deductibles will naturally lead to higher premiums, regardless of the vehicle type. Increasing deductibles can be an effective way to lower premiums.

- Annual Mileage: Vehicles driven more frequently or for longer distances are perceived as higher risk.

Credit History: In many states, a good credit history can lead to lower insurance rates.

- Considering these individual variables, it becomes clear that a direct “yes” or “no” answer to are hybrid cars more expensive to insure requires a personalized assessment.

The Role of Reliability and Resale Value

Modern hybrid vehicles have, in many cases, demonstrated excellent reliability. Consumer Reports’ Annual Auto Reliability Survey often shows hybrids as significantly more reliable overall than gasoline-only vehicles, with 26% fewer problems on average. This robust reliability can, over time, positively influence insurance rates as it may lead to fewer claims related to mechanical breakdowns.

Furthermore, hybrids tend to retain their value well due to strong demand and fuel savings, which can also factor into insurance calculations, as the replacement cost for insurers remains higher. However, the long-term cost of replacing a high-voltage battery can be a concern for resale, though many batteries come with extensive warranties (e.g., Toyota offers 10-year/150,000-mile warranties). This balance between proven reliability and potential high-cost component replacement forms part of the ongoing actuarial challenge for insurers.

Strategies to Potentially Lower Your Hybrid Car Insurance Costs

Despite the general trend of higher premiums for hybrids, there are several proactive strategies that consumers can employ to mitigate costs and potentially secure more affordable coverage. Understanding these options is essential for any car enthusiast looking to optimize their vehicle ownership expenses. Even if you’re wondering are hybrid cars more expensive to insure, these tips can help balance the equation.

Many insurance providers recognize the benefits of hybrid technology and safe driving practices, offering various incentives and discounts. By carefully evaluating policy options and personal driving habits, hybrid owners can often find significant savings.

Leveraging Discounts and Incentives

Many insurance companies offer specific discounts for hybrid or “green” vehicles, sometimes referred to as “alternative fuel auto discounts.” These can range from 5% to 10% off annual premiums. It is always advisable to inquire about such discounts when obtaining quotes.

Other common discounts that apply to all vehicle types, including hybrids, include:

- Good Driver/Safe Driver Discounts: Maintaining a clean driving record, free of accidents and violations, is one of the most effective ways to reduce premiums. Some insurers even offer discounts for participating in telematics programs that monitor driving habits.

- Multi-Policy/Bundling Discounts: Combining auto insurance with other policies like home or renter’s insurance can lead to significant savings.

- Low Mileage Discounts: If your annual mileage is below a certain threshold, you may qualify for a discount. Hybrid drivers, while often driving more due to fuel efficiency, can still benefit if their usage is below average.

- Anti-Theft Device Discounts: Most new hybrids come equipped with advanced anti-theft systems, which can lead to further discounts.

- Paying in Full or Auto-Pay Discounts: Many insurers offer small discounts for paying the annual premium upfront or signing up for automatic payments.

Choosing the Right Coverage and Provider

Comparing quotes. Some insurers may specialize in offering more competitive rates for eco-friendly vehicles or have better claim processing for advanced technology.

When selecting coverage, carefully consider your deductibles and coverage limits. Opting for a higher deductible, the amount you pay out-of-pocket before insurance kicks in, can lower your overall premium. However, ensure that the deductible is an amount you can comfortably afford in an emergency. Similarly, setting appropriate coverage limits can help manage costs, though it is crucial not to under-insure, especially with the higher replacement value of hybrids. Some policies also offer add-ons like extended battery warranties or specialized roadside assistance for hybrid-specific issues, which might be worth considering for peace of mind.

Conclusion

The question, are hybrid cars more expensive to insure, generally yields a “yes,” with premiums typically ranging from 5% to 11% higher than comparable gasoline-powered vehicles. This cost difference is largely driven by the hybrid’s higher purchase price, the expense of specialized components like battery packs, and the need for expert technicians and costly parts for repairs. However, this is not a universal truth, and numerous factors,